Taxpayers shouldn't be burdened with propping up the Church

Posted: Thu, 20th Jul 2023 by Stephen Evans

Faced with dwindling congregations, the Church of England is looking for ways to fund the growing repair bill of its aging buildings. Could your taxes be the answer?

Quite possibly, yes. Because the Church has successfully lobbied the government to allow more money to flow from cash-strapped local authorities to places of worship.

Using her seat in the House of Lords to further the Church's interests, the bishop of Bristol Vivienne Faull argued that legal uncertainly was preventing parish and town councils from funding church repairs.

The uncertainty stems from two conflicting bits of legislation – the Parish Councils Act 1894, which says that funds cannot be given to churches, and the Local Government Act 1972, which says that they can.

Now, faith and communities minister Baroness Scott has added an amendment to the Levelling Up Bill which will abolish a clause in the 1894 act to make clear that local authorities can fund churches and other places of worship.

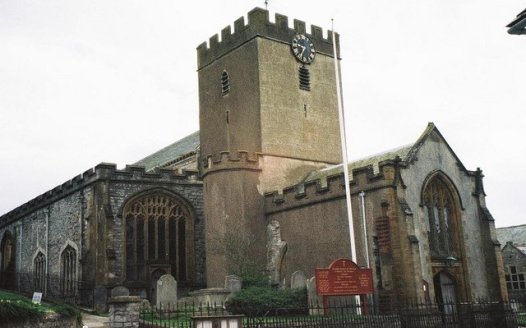

Many churches hold historical and architectural significance. Few would want to see them fall into a state of disrepair. But who should foot the bill for their maintenance? Before any public money is spent, questions need to be asked about whether the organisation responsible for their upkeep has the means to do so.

England's 16,000 Anglican places of worship are the responsibility of the Church of England. The CofE is one of the largest private landowners in the UK and sits on £10.3 billion investment fund. Its assets were estimated in 2016 at £23 billion, since when the fund has grown by £3.6 billion.

Speaking in the House of Lords, Lib Dem peer Paul Scriven argued that if any of the Acts should be withdrawn, it should be the 1972 Act, not the 1894 Act. When it comes to maintaining religious buildings "the first port of call should be the reserves which the Church of England holds", he argued.

This view was echoed by Baroness Lorely Burt, who suggested more state subsidies would be an "inappropriate use of taxpayers' money" given the "extreme wealth" of the Church of England.

Despite its significant wealth, the CofE frequently pleads poverty. Due its fragmented financial and organisational structure, the Church can hide its money in plain sight, leaving many parishes in dire financial difficulty and struggling to afford repairs.

But the CofE can certainly find money when it wants to. Between 2017 and 2020, £248 million was allocated to evangelism as part of the Church's (so far unsuccessful) efforts to attract new worshippers. This has included splashing the cash on 'planting' new churches, hiring 'social media pastors', converting a nightclub in Bradford into a church with a gym to attract students, and recruiting children and young people's 'mission enablers' to "bring Christ to young people".

This year it also announced a £100m fund to make reparations for its slave trade links. And in a bid to tempt couples back to church weddings (which fell by half between 1999 and 2019) the Church has just voted to trial dropping its £500 fee for weddings. So, while lobbying for easier access to public funds for church buildings, the church is turning its back on a reliable source of income.

Churches, like any other organisation, should be responsible for their financial sustainability.

The Church of England received £750 million of public money between 2016 and 2021. This level of reliance on government funding risks creating dependency and discouraging financial accountability.

Britain is no longer a majority Christian nation. Fewer that 1% of the English population attend Anglican services on the average Sunday. With emptying pews and ageing congregations, the Church needs to face up to reality and downsize to survive. Until it learns this lesson, taxpayers shouldn't be further burdened with propping up an ailing yet wealthy religious institution.

As well as the practical reasons for resisting state grants to religion, there is also an important one of principle. Taxpayers at odds with the Church's doctrine and those it discriminates against, such as same sex couples who aren't even permitted to marry in their churches, may well have reasonable objections to their money funding a religion they reject. Providing financial support to religious institutions blurs the lines between the government and religions and undermines the state's commitment to treating all citizens equally.

So, when local churches come knocking for local authority grants, councils should remind them of the Church's wealth and refer them back to their powers above.

Image: UKgeofan at English Wikipedia, CC BY-SA 3.0

Separate Church and State

We want to separate church and state so no religion has undue influence over our politics and society. Join our campaign to disestablish the Church of England.